Saving or Investing: What’s the Best Money Move for You?

Money Dilemma: Save or Invest?

In today’s fast-paced world, we are constantly bombarded with choices on how to manage our finances. One of the most common dilemmas that people face is whether to save their money or invest it. Both saving and investing have their own benefits and drawbacks, so it’s important to carefully consider which option is the best money move for you.

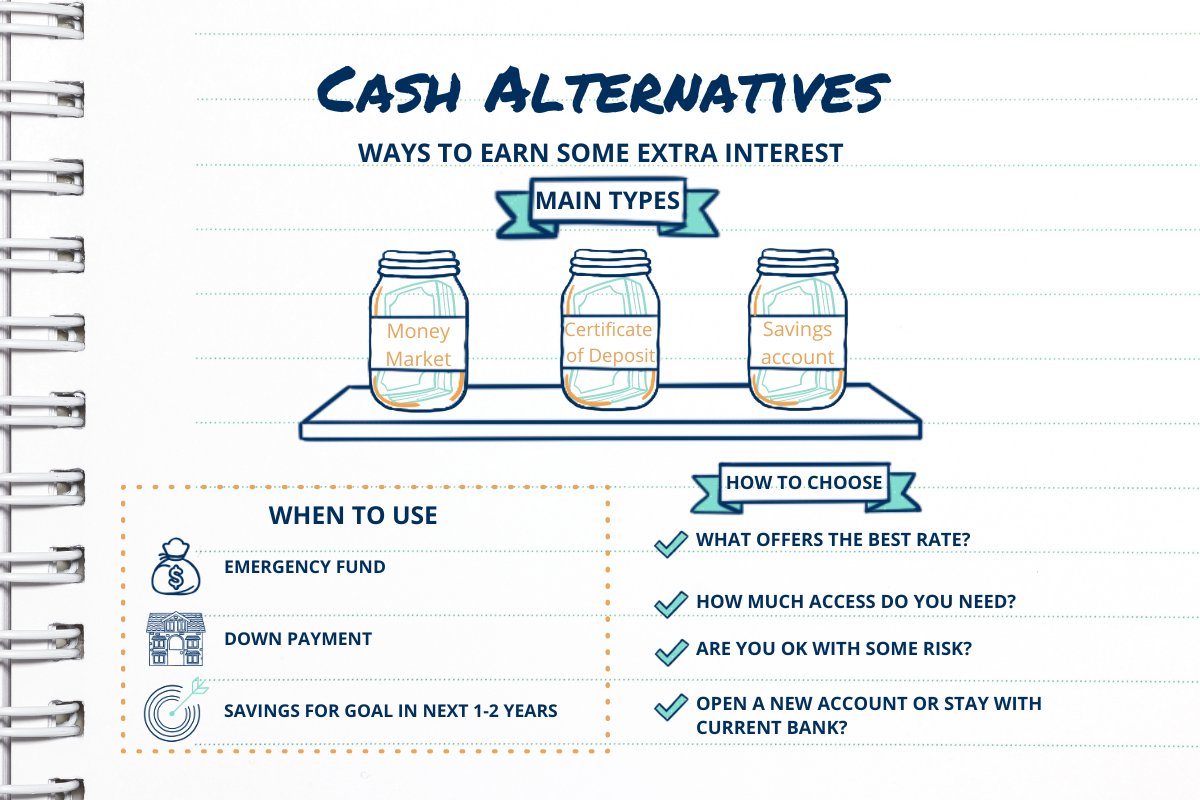

Let’s start by looking at saving. Saving is the act of setting aside a portion of your income for future use. This can be done by putting money into a savings account, a certificate of deposit (CD), or even a piggy bank. Saving is a great way to build up a financial safety net for unexpected expenses or emergencies. It can also help you reach short-term financial goals, such as buying a new car or going on a vacation.

On the other hand, investing involves putting your money into assets that have the potential to grow in value over time. This can include stocks, bonds, real estate, or even starting your own business. Investing is a way to make your money work for you and potentially earn a higher return than what you would get from a traditional savings account. However, investing also comes with risks, as the value of your investments can go up or down depending on market conditions.

So, how do you decide whether to save or invest? The answer depends on your financial goals, risk tolerance, and time horizon. If you have short-term financial goals, such as saving for a down payment on a house or a new car, then saving may be the best option for you. Saving allows you to protect your money and have access to it when you need it.

Image Source: planningretirements.com

On the other hand, if you have long-term financial goals, such as saving for retirement or your child’s education, then investing may be a better choice. Investing allows you to take advantage of the power of compound interest and potentially earn a higher return on your money over time. However, it’s important to remember that investing also comes with risks, so it’s important to do your research and seek advice from a financial advisor before making any investment decisions.

Ultimately, the best money move for you will depend on your individual financial situation and goals. Some people may choose to save and invest simultaneously, while others may focus on one strategy over the other. Whatever you decide, the key is to make sure that your money is working for you and helping you reach your financial goals.

In conclusion, the decision to save or invest is a personal one that should be based on your financial goals, risk tolerance, and time horizon. Saving is a great way to build up a financial safety net and reach short-term goals, while investing can help you grow your money over time and reach long-term goals. By carefully considering your options and seeking advice when needed, you can make the best money move for you and secure your financial future.

Make Your Money Work for You!

Are you looking to make the most of your hard-earned money? Do you want to see your money grow and work for you, rather than just sitting in a savings account? If so, it might be time to consider investing your money wisely.

When it comes to managing your finances, there are two main options: saving and investing. While saving money is important for short-term goals and emergencies, investing is a key way to build long-term wealth and secure your financial future. So, what exactly does it mean to make your money work for you through investing?

Investing involves putting your money into assets that have the potential to grow in value over time. This can include stocks, bonds, real estate, or mutual funds. By investing your money, you are essentially putting it to work in the hopes of earning a return on your investment.

One of the key benefits of investing is the potential for higher returns compared to simply saving your money in a low-interest savings account. While savings accounts offer a safe and secure place to keep your money, the interest rates are often minimal, and your money may not grow significantly over time.

On the other hand, investing offers the potential for higher returns, as your money has the opportunity to grow through market fluctuations and economic growth. Of course, with higher returns comes higher risks, as the value of your investments can go up or down depending on market conditions.

For those who are new to investing, it can seem like a daunting and complex world. However, with the right knowledge and guidance, investing can be a powerful tool for building wealth and achieving your financial goals.

There are many different ways to invest your money, from individual stocks and bonds to mutual funds and exchange-traded funds (ETFs). Each type of investment has its own level of risk and potential return, so it’s important to do your research and choose investments that align with your financial goals and risk tolerance.

One popular way to invest is through a retirement account, such as a 401(k) or IRA. These accounts offer tax advantages and can help you save for retirement over the long term. By contributing regularly to a retirement account and investing in a diversified portfolio, you can grow your savings and build a nest egg for the future.

Another option for investing is real estate. Real estate can be a lucrative investment, as property values tend to appreciate over time. Whether you choose to invest in rental properties, commercial real estate, or real estate investment trusts (REITs), real estate can be a valuable addition to your investment portfolio.

In addition to traditional investments, there are also alternative investment options to consider, such as peer-to-peer lending, cryptocurrencies, or precious metals. These alternative investments can offer diversification and potential for high returns, but they also come with increased risk and volatility.

Ultimately, the key to making your money work for you through investing is to create a well-rounded investment portfolio that aligns with your financial goals and risk tolerance. By diversifying your investments across different asset classes and industries, you can spread out risk and maximize your potential for returns.

So, if you’re looking to make your money work for you and build long-term wealth, consider exploring the world of investing. With the right knowledge and strategy, you can grow your savings, achieve your financial goals, and secure your financial future.

Saving vs. Investing: Which Financial Strategy Should You Choose?