Sailing Through Inflation: Safeguard Your Investments!

Ahoy, fellow investors! Inflation can sometimes feel like a stormy sea, threatening to sink your hard-earned money. But fear not, for with the right strategies and a steady hand on the helm, you can navigate these choppy waters and safeguard your investments. In this article, we will explore some tips and tricks to help you sail through inflation with confidence.

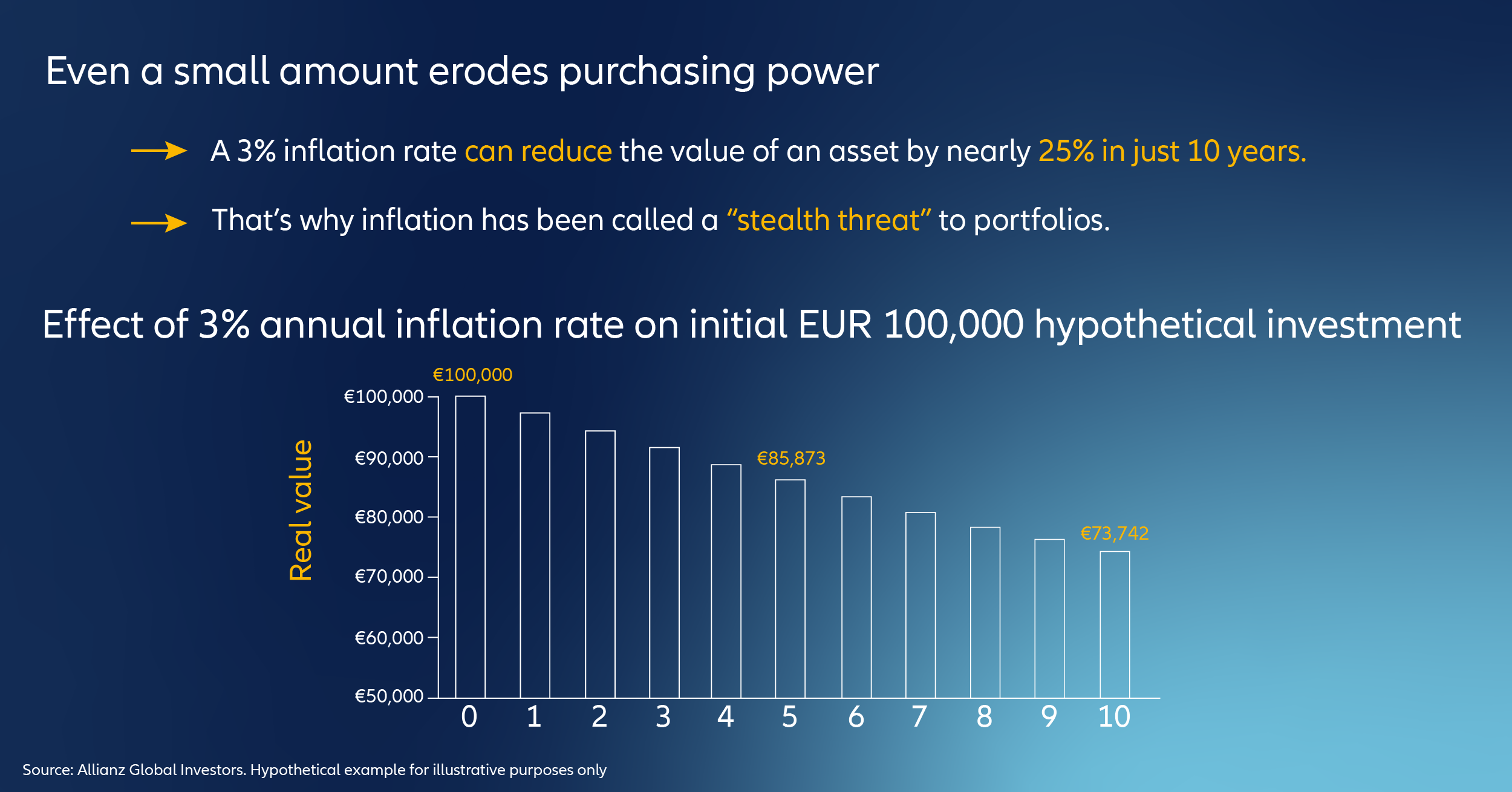

First and foremost, it’s important to understand the effects of inflation on your investments. Inflation erodes the purchasing power of your money over time, meaning that the same amount of money will buy you less in the future. This can have a significant impact on your investments, especially if they are not keeping pace with inflation. To protect your investments from the ravages of inflation, it’s crucial to take proactive steps to ensure that they continue to grow in real terms.

One of the most effective ways to safeguard your investments against inflation is to diversify your portfolio. By spreading your investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the risk of being hit hard by inflation in any one sector. Diversification can help you weather the ups and downs of the market and ensure that your investments continue to grow over the long term.

Another key strategy for protecting your investments from inflation is to invest in assets that tend to perform well during periods of high inflation. For example, real assets such as gold, real estate, and commodities have historically been good hedges against inflation, as their value tends to rise when the purchasing power of the dollar diminishes. By allocating a portion of your portfolio to these types of assets, you can help offset the effects of inflation on your overall investment returns.

Image Source: allianz.com

In addition to diversifying your portfolio and investing in inflation-resistant assets, it’s also important to stay on top of your investments and make adjustments as needed. Keep a close eye on the performance of your investments and be prepared to reallocate your assets if necessary. For example, if inflation is on the rise, you may want to increase your exposure to inflation-resistant assets and reduce your holdings in sectors that are more vulnerable to inflationary pressures.

Furthermore, consider investing in Treasury Inflation-Protected Securities (TIPS), which are specifically designed to protect investors from inflation. TIPS are government bonds that adjust their principal value based on changes in the Consumer Price Index (CPI), ensuring that investors receive a return that is adjusted for inflation. By incorporating TIPS into your investment portfolio, you can help mitigate the effects of inflation on your overall investment returns.

Lastly, don’t forget the power of compounding when it comes to protecting your investments from inflation. Reinvesting your dividends and interest payments can help your investments grow over time, allowing you to stay ahead of inflation and preserve the purchasing power of your money. By harnessing the magic of compounding, you can turn a modest investment into a substantial nest egg that can weather the effects of inflation and provide for your financial future.

In conclusion, navigating the effects of inflation on your investments requires a combination of foresight, strategy, and diligence. By diversifying your portfolio, investing in inflation-resistant assets, staying vigilant, and harnessing the power of compounding, you can safeguard your investments against the erosive effects of inflation and steer your financial ship towards a bright and prosperous future. So hoist the sails, set a course for financial success, and sail confidently through the stormy seas of inflation!

Weathering the Storm: Strategies for Inflation Protection

Inflation can be a daunting force that can wreak havoc on your investments if you’re not prepared. As prices rise and the value of your money decreases, it’s important to have strategies in place to protect your portfolio from the effects of inflation. Here are some tips to help you weather the storm and keep your investments safe.

One of the first strategies for protecting your investments from inflation is to diversify your portfolio. By spreading your investments across a variety of asset classes, you can help minimize the impact of inflation on your overall portfolio. This could include investing in stocks, bonds, real estate, and commodities. Diversification can help you weather the storm of inflation by ensuring that not all of your investments are affected in the same way.

Another key strategy for inflation protection is to invest in assets that have historically outperformed inflation. This could include assets such as stocks, real estate, and precious metals. These assets have the potential to increase in value over time, helping you maintain the purchasing power of your investments even as prices rise.

In addition to investing in inflation-beating assets, it’s important to consider the impact of inflation when setting your investment goals. Inflation can erode the value of your money over time, so it’s important to factor this into your long-term financial planning. By setting realistic investment goals that take inflation into account, you can better protect your investments from the effects of rising prices.

One way to protect your investments from inflation is to consider investing in Treasury Inflation-Protected Securities (TIPS). These government-issued bonds are specifically designed to protect investors from inflation by adjusting their principal value in line with changes in the Consumer Price Index. By investing in TIPS, you can help safeguard your investments from the effects of inflation and ensure that your money retains its purchasing power over time.

Another strategy for protecting your investments from inflation is to consider investing in dividend-paying stocks. Companies that pay dividends can provide a reliable source of income that can help offset the effects of inflation. By reinvesting your dividends, you can also take advantage of compounding returns, helping your investments grow over time even as prices rise.

It’s also important to consider the impact of inflation on your fixed-income investments. As prices rise, the purchasing power of fixed-income investments such as bonds can decrease. To protect your investments from the effects of inflation, consider investing in bonds with adjustable interest rates or shorter maturities. This can help ensure that your investments keep pace with inflation and maintain their value over time.

In conclusion, protecting your investments from the effects of inflation requires careful planning and strategic thinking. By diversifying your portfolio, investing in inflation-beating assets, setting realistic goals, and considering inflation-protected securities, you can help safeguard your investments from the impact of rising prices. With these strategies in place, you can weather the storm of inflation and keep your investments safe for the long term.

The Impact of Inflation on Your Investments and How to Protect Yourself