Unlock Your Potential: Diversify Your Portfolio

When it comes to investing, diversification is key. It’s a strategy that involves spreading your investments across a variety of different assets in order to reduce risk and maximize returns. By diversifying your portfolio, you can protect yourself from the ups and downs of the market and increase your chances of long-term success.

One of the main reasons why diversification is so important is because it helps to mitigate the risks associated with investing. When you put all of your money into one asset or asset class, you are putting yourself at risk of losing everything if that particular investment performs poorly. However, by spreading your investments across multiple assets, you can reduce the impact of any one investment underperforming.

Diversification also allows you to take advantage of different market conditions. Not all assets perform well at the same time, so by diversifying your portfolio, you can ensure that you always have some investments that are doing well, even if others are struggling. This can help to stabilize your overall returns and protect your wealth over the long term.

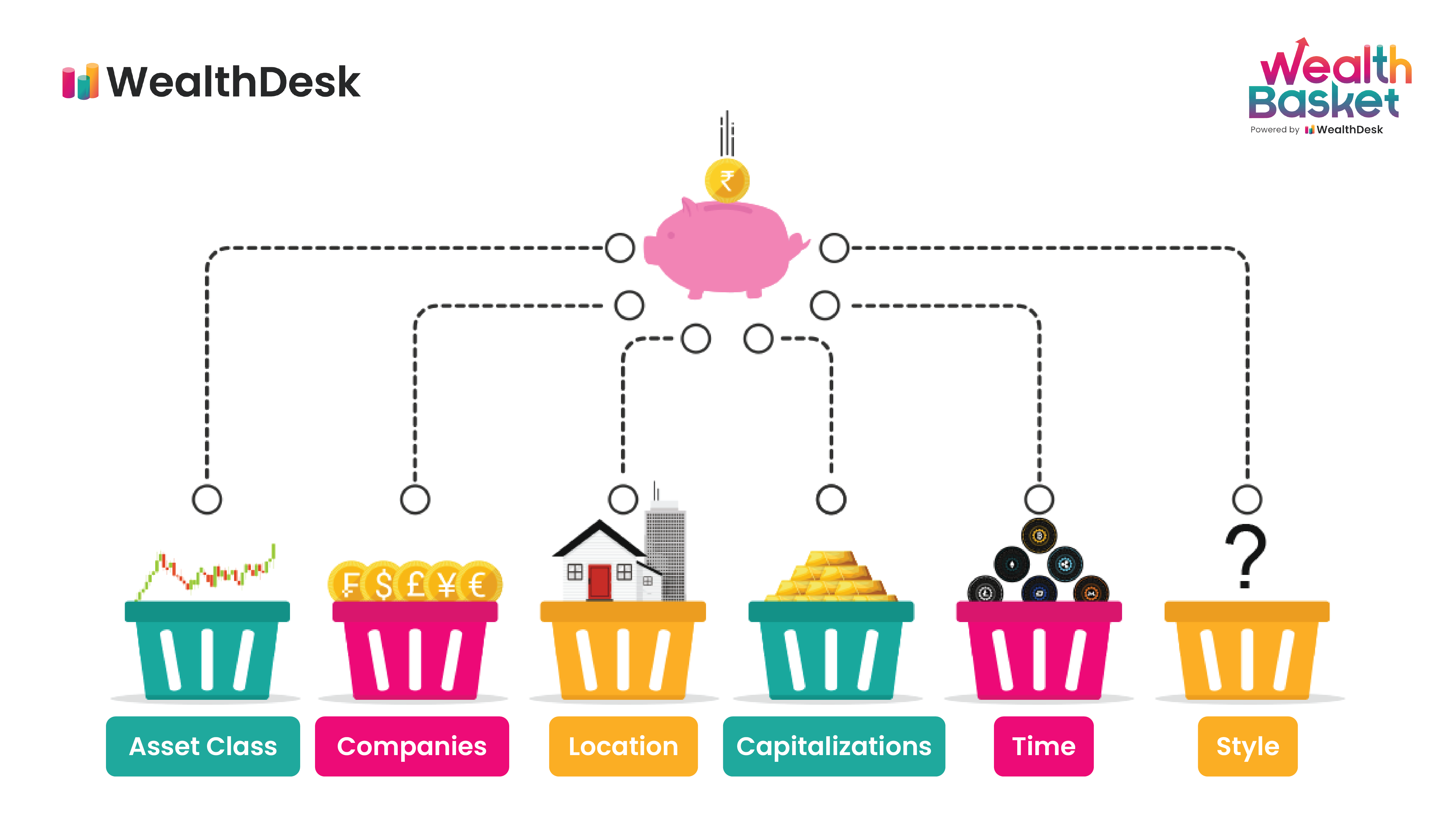

There are many ways to diversify your portfolio, including investing in stocks, bonds, real estate, and commodities. You can also diversify geographically by investing in assets from different countries and regions. By spreading your investments across a variety of different assets, you can reduce your overall risk and increase your chances of achieving your financial goals.

Image Source: wealthdesk.in

Another important aspect of diversification is asset allocation. This involves determining the right mix of assets for your portfolio based on your risk tolerance, investment goals, and time horizon. By diversifying your portfolio across different asset classes, you can achieve a balance between risk and return that is suitable for your individual circumstances.

In addition to diversifying across different assets and asset classes, it’s also important to regularly review and rebalance your portfolio. As the market changes and your investment goals evolve, you may need to adjust your asset allocation to ensure that it remains in line with your objectives. By staying proactive and regularly monitoring your portfolio, you can maximize your returns and reduce your overall risk.

In conclusion, diversifying your portfolio is a crucial step in maximizing your investments and achieving long-term financial success. By spreading your investments across a variety of different assets and asset classes, you can reduce risk, take advantage of different market conditions, and achieve a balance between risk and return that is suitable for your individual circumstances. So unlock your potential today and start diversifying your portfolio for a brighter financial future.

The Key to Success: Maximizing Your Investments

When it comes to investing, one of the most important strategies you can implement is diversifying your portfolio. By spreading your investments across a variety of different assets, you can reduce risk and maximize your potential for returns. In this article, we will explore the key to success in investing and how you can effectively diversify your portfolio to achieve your financial goals.

Diversification is like the secret sauce of investing. It is the key to success because it helps you spread out risk and avoid putting all your eggs in one basket. When you diversify your portfolio, you are essentially spreading your money across different types of investments, such as stocks, bonds, real estate, and commodities. This way, if one asset class underperforms, you have other investments that can help offset any losses.

So, how can you effectively diversify your portfolio to maximize your investments? The first step is to assess your risk tolerance and investment goals. Are you looking for long-term growth or are you more interested in preserving capital? Once you have a clear understanding of your financial objectives, you can start building a diversified portfolio that aligns with your risk tolerance and goals.

One common strategy for diversifying your portfolio is to invest in a mix of asset classes. For example, you could allocate a percentage of your portfolio to stocks, bonds, and real estate. Stocks are known for their potential for high returns but also come with higher risk, while bonds are more stable but offer lower returns. By combining these different asset classes, you can create a well-rounded portfolio that is less susceptible to market volatility.

Another way to diversify your portfolio is to invest in different industries and sectors. For example, instead of just investing in tech stocks, you could also consider adding healthcare, energy, and consumer goods stocks to your portfolio. This way, if one sector experiences a downturn, your overall portfolio won’t be heavily impacted.

It’s also important to consider geographic diversification when building your portfolio. Investing in assets from different regions can help protect your investments from country-specific risks, such as political instability or economic downturns. By spreading your investments across different countries and regions, you can further reduce risk and maximize your potential for returns.

In addition to diversifying across asset classes, industries, and regions, it’s also important to regularly review and rebalance your portfolio. As market conditions change, some investments may outperform while others underperform. By periodically rebalancing your portfolio, you can ensure that your asset allocation stays in line with your investment goals and risk tolerance.

In conclusion, diversification is the key to success when it comes to maximizing your investments. By spreading your money across different asset classes, industries, and regions, you can reduce risk and increase your chances of achieving your financial goals. Remember to regularly review and rebalance your portfolio to ensure that it continues to align with your investment objectives. By following these strategies, you can build a well-diversified portfolio that sets you up for success in the world of investing.

The Best Ways to Diversify Your Investment Portfolio