Building a Diverse Investment Portfolio for Optimal Returns

Crafting a Rainbow Portfolio for Prosperity

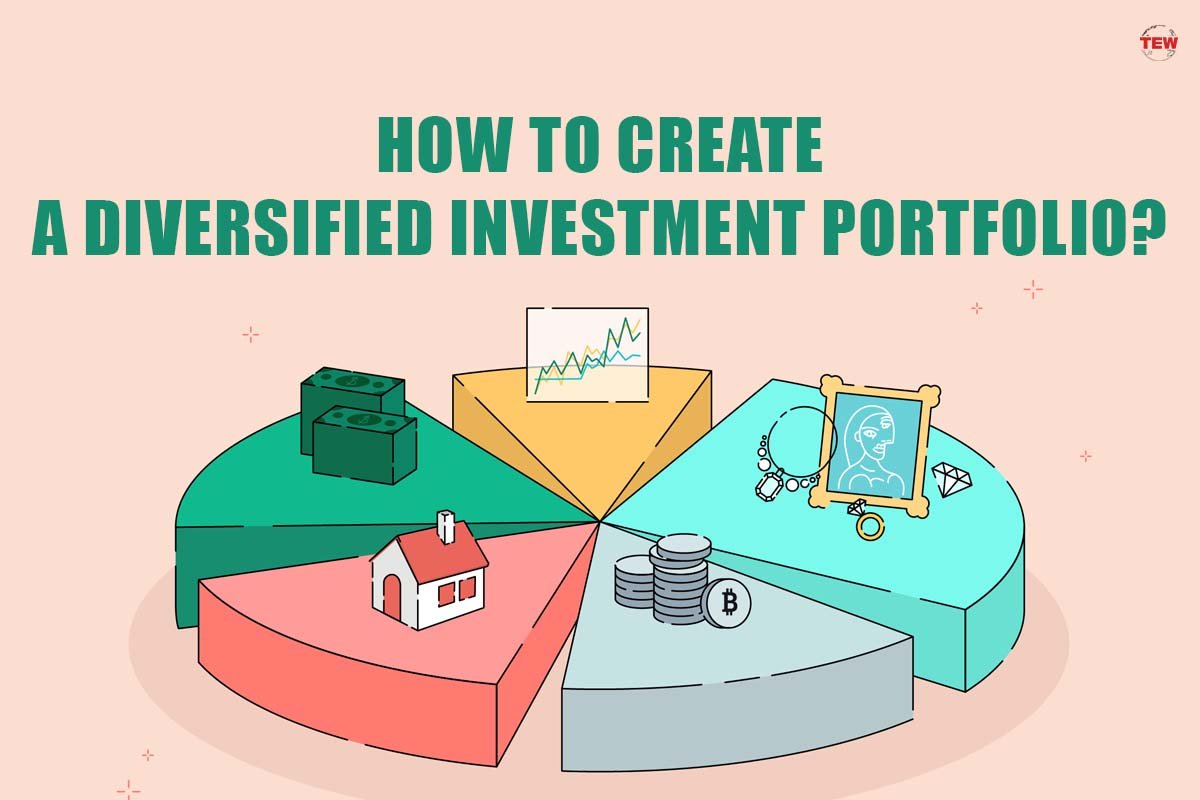

When it comes to investing, the key to success lies in diversification. By spreading your investments across a variety of asset classes, industries, and geographical regions, you can reduce risk and maximize returns. This strategy is often referred to as building a rainbow portfolio – a colorful mix of investments that can lead you to prosperity.

Diversifying your investment portfolio is like planting a garden with a variety of flowers. Each flower has its own unique characteristics and requirements, but together they create a beautiful and vibrant display. In the same way, each investment in your portfolio will have its own risks and potential returns, but by combining them strategically, you can create a strong and resilient portfolio that can weather any storm.

One of the key benefits of a rainbow portfolio is that it can help you achieve optimal returns. By investing in a variety of asset classes, such as stocks, bonds, real estate, and commodities, you can spread your risk and increase your chances of capturing gains in different market conditions. For example, when stocks are down, bonds may provide a stable source of income. When real estate is booming, commodities like gold or oil may offer strong returns.

In addition to asset classes, it’s also important to diversify across industries and geographical regions. Investing solely in one industry or region can expose you to concentrated risk. For example, if you only invest in technology stocks, your portfolio may suffer if the tech sector experiences a downturn. By spreading your investments across different industries, such as healthcare, finance, and consumer goods, you can reduce the impact of any one sector on your overall portfolio.

Image Source: theenterpriseworld.com

Similarly, investing in companies from different countries can help you mitigate geopolitical risks and take advantage of global growth opportunities. For example, emerging markets like China and India may offer higher growth potential than developed markets like the US and Europe. By including international stocks and bonds in your portfolio, you can tap into these opportunities and diversify away from the risks of a single country’s economy.

Another key aspect of building a rainbow portfolio is to consider your investment time horizon and risk tolerance. Younger investors with a long time horizon may be able to take on more risk in pursuit of higher returns, while older investors nearing retirement may prefer a more conservative approach to preserve their capital. By aligning your investments with your goals and risk tolerance, you can build a portfolio that meets your needs and provides the optimal balance of risk and reward.

In conclusion, crafting a rainbow portfolio for prosperity involves diversifying across asset classes, industries, and geographical regions to maximize returns and minimize risk. By taking a strategic approach to building your investment portfolio, you can create a strong and resilient foundation for long-term growth and financial success. So why wait? Start building your rainbow portfolio today and watch your investments bloom and flourish.

Unleash Your Investment Potential with Diversity

When it comes to building a successful investment portfolio, diversity is key. Having a range of different investment options in your portfolio can help reduce risk and maximize returns. By spreading your investments across various asset classes, industries, and geographic regions, you can take advantage of different market trends and opportunities.

Diversifying your investment portfolio can help you weather market fluctuations and economic downturns. When one asset class is performing poorly, another may be thriving, helping to balance out your overall returns. This can help protect your investments from significant losses and ensure that you are well-positioned to take advantage of future growth opportunities.

One of the simplest ways to diversify your investment portfolio is by investing in different asset classes. Stocks, bonds, real estate, and commodities all have unique risk and return characteristics, so by spreading your investments across these different asset classes, you can reduce the overall risk of your portfolio. This can also help you take advantage of different market cycles and earn more consistent returns over time.

In addition to diversifying across asset classes, it is also important to diversify within each asset class. For example, within the stock market, you can invest in large-cap, mid-cap, and small-cap companies, as well as international companies. By diversifying within the stock market, you can reduce company-specific risk and take advantage of growth opportunities in different sectors and regions.

Another way to diversify your portfolio is by investing in different industries. Different industries may perform better or worse at different points in the economic cycle, so by investing in a range of industries, you can reduce the overall risk of your portfolio. For example, during a recession, healthcare and consumer staples companies may outperform while technology and consumer discretionary companies may struggle.

Geographic diversification is also important when building a diverse investment portfolio. By investing in different countries and regions, you can reduce the impact of local economic and political events on your portfolio. This can help protect your investments from currency fluctuations, trade disputes, and other geopolitical risks that may affect specific countries or regions.

In addition to asset class, industry, and geographic diversification, it is also important to consider factors such as investment style and time horizon when building a diverse investment portfolio. For example, you may want to include both growth and value stocks in your portfolio to take advantage of different investment strategies. You may also want to consider your investment time horizon and risk tolerance when deciding how to allocate your investments.

Overall, building a diverse investment portfolio is essential for maximizing returns and reducing risk. By spreading your investments across different asset classes, industries, and geographic regions, you can take advantage of different market trends and opportunities while protecting your investments from significant losses. So unleash your investment potential with diversity and watch your portfolio thrive!

How to Create a Diversified Investment Portfolio for Maximum Returns